Fun Fedex Merchandise Processing Fee

The ATA Carnet is an international document that allows for duty-free temporary import and re-export of goods between 87 countries and territories.

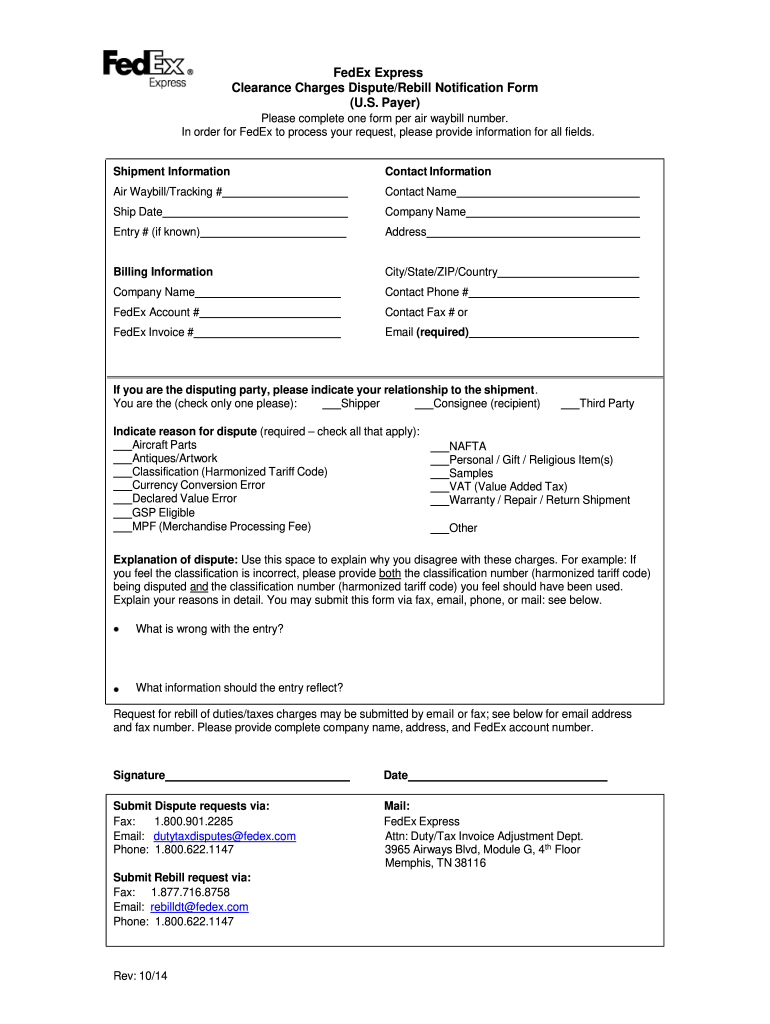

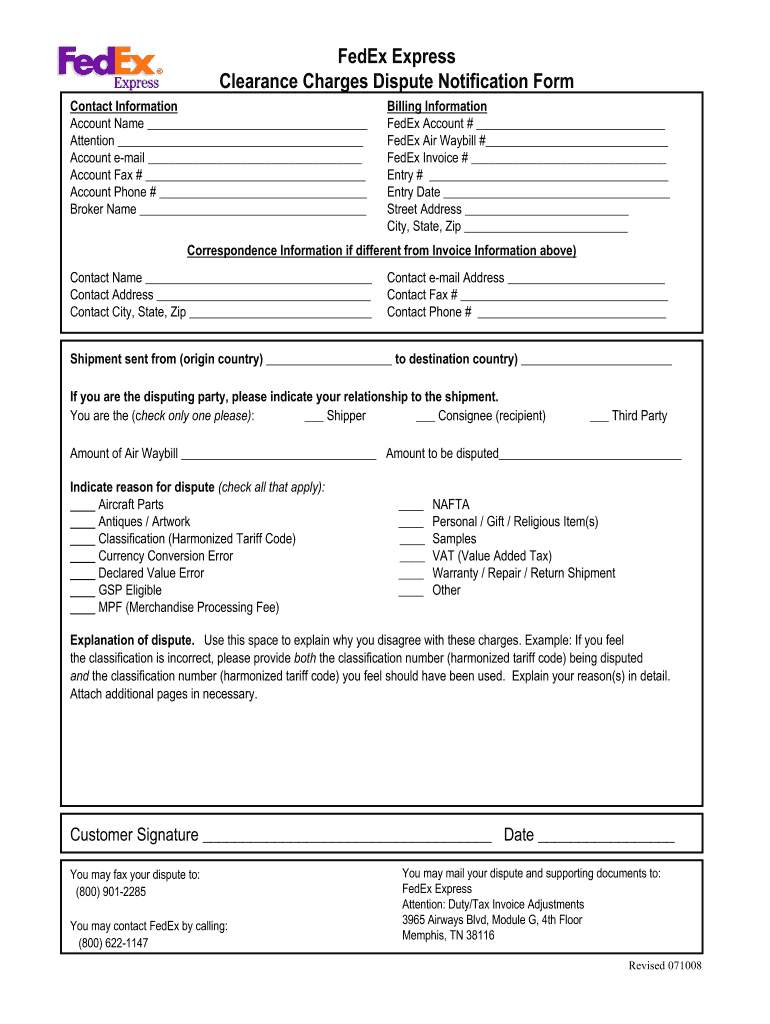

Fedex merchandise processing fee. Fees that will see increases not all-inclusive. The Merchandise Processing Fee MPF is a fee assessed by US Customs for most imports into the US. Merchandise Processing Fee MPF and Preference Program TableMany preference programs provide an MPF exemptionMerchandise Processing Fee RegulationsSee 19 CFR 2423c for the regulation providing this exemptionMPF Exemption on Unconditionally Free Goods - CSMS message 09-000292The MPF exemption is available to unconditionally free goods even though Free.

Each of these companies charge different fees for processing the duty filing forms and the fee typically ranges from 25 to 40 depending on the carrier. Please note the following. If the entry value is less than 2500 MPF is a 218 flat rate The minimum and.

MPF for informal entries is a set fee and ranges from 200 600 or 900 per shipment. The MPF is assessed and paid at the time of entry summary and the fee is based on the value of the merchandise being imported not including duty freight and insurance charges. For formal entries merchandise value exceeding 2500 USD MPF is assessed on an ad valorem according to value basis at 03464 of the entered value.

Select the correct return reason from the table below. The MPF has been in place for thirty years and has been the subject of criticism and debate throughout this time. Per day for the second week and beyond 70.

Since MPF are paid on an entry basis reducing entries to once weekly can reduce MPF costs significantly. Per day for the first week after 48 hours 008 per lb. Only the minimum and maximum amounts are changing.

During this period the ATA Carnet. However the minimum and maximum MPF amounts will change. When importing into the US landed cost calculations must include both the duty on the product and associated fees like the Merchandise Processing Fee MPF.